Social impact bonds: how to engage with potential investors

A practical guide to help you find and engage with organisations and individuals to invest in your social impact bond.

- Social impact bonds (SIBs) provide an innovative funding mechanism to enable service providers to enter into outcomes contracts with governments.

- It can be difficult finding investors that are looking to invest in SIBs and knowing when and how to engage with them.

- There are no hard and fast rules as it can vary significantly depending on the type of investor. This article will take you through how you might engage with potential investors throughout the SIB development lifecycle.

The idea of finding and working with private investors to help fund an innovative project can be daunting.

Recently, the Victorian Department of Treasury and Finance commissioned SVA to develop practical guidance for for-purpose organisations requiring assistance to attract and engage with investors for Social Impact Bonds (SIBs). Many of the tips and considerations in this article will be equally relevant to for-purpose organisations seeking other types of impact investment too.

Investors can refer to a broad range of organisations and entities – fund managers, superannuation funds, banks, other financial institutions, foundations, families and individuals. Investors, in most cases, only provide ‘returnable’ capital (i.e. the money must be repaid) which is different to grant funding or donations (which don’t need to be repaid).

For further detail on the tips and considerations explored in this article, refer to the detailed guide.

SIB investor pre-requisites

Social impact bonds (SIBs) provide an innovative funding mechanism to enable service providers to enter into outcomes contracts with governments. Investors provide upfront capital to co-fund your program and are repaid if the target outcomes are achieved according to the outcomes contract. Investor returns are typically funded by government payments under the outcomes contact.

For further information on how SIBs work, refer to our guide to outcomes contracting and social impact bonds.

If you are planning a SIB, there are some important pre-requisites before you start engaging with potential investors:

- An outcomes contract funding opportunity with government

- A program that is suitable for a SIB. See this article for a practical guide to help you self-assess your program’s appropriateness for a SIB.

- Capacity to commit time and resources to developing a SIB. Developing a SIB can be relatively resource intensive, requiring additional capabilities and support from organisational leadership.

Finding potential investors

It can be difficult finding investors that are looking to invest in SIBs. The Impact Investing Hub investor directory and Impact Investing Australia website can assist you with finding potential investors (although not all investors or organisations listed there are always looking to invest in SIBs).

Some investors engage impact investment advisors, such as Australian Impact Investments, to provide them with advice on potential investments.

There may also be other organisations out there seeking to deploy capital into initiatives like SIBs, so it may be worth speaking to your non-government funders to understand if this is something they are interested in.

How and when to engage with potential investors

There are no hard and fast rules as your engagement may vary significantly depending on the type of investor. Some investors may prefer to be engaged earlier in the process, where others will prefer to wait until the investment opportunity is fully developed and the capital raise is ‘live’.

Most investors do not have the internal capabilities or capacity to structure SIBs – this is the responsibility of the service provider or an intermediary like SVA.

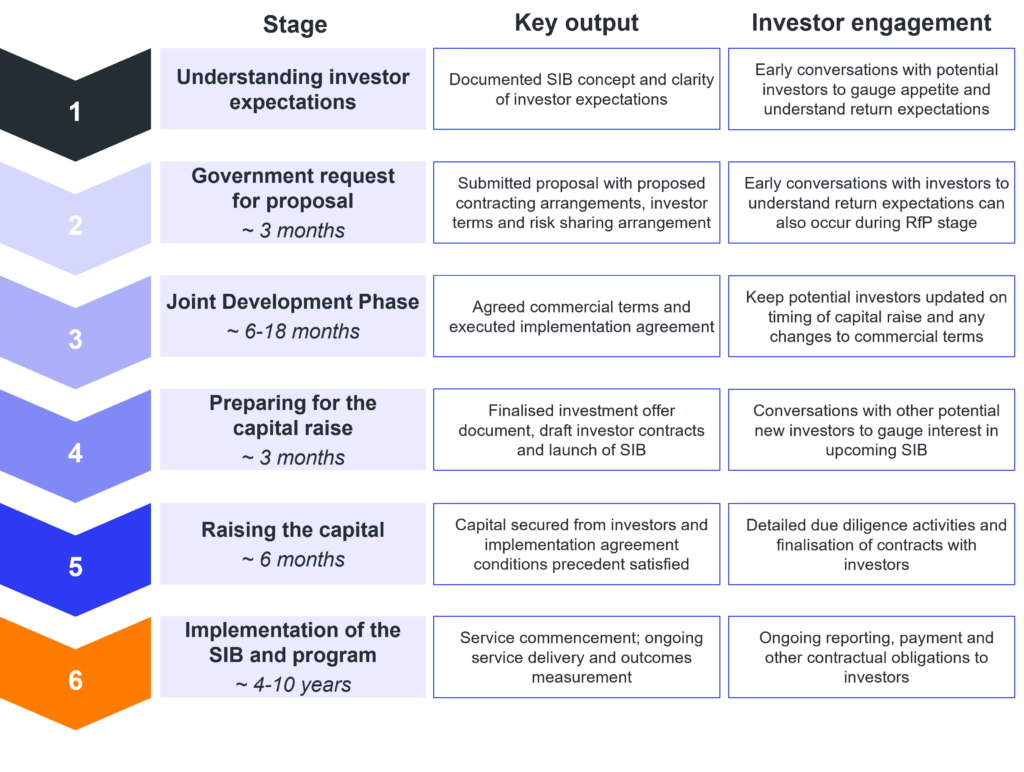

Developing a SIB might take as little as a year, or as long as two to three years to successfully launch and commence service delivery. Engagement with investors can occur before government tenders a SIB opportunity, and at a range of points throughout the joint development process with government. The diagram below summarises the investor engagement and outputs required at each stage of the SIB development process. This process is illustrative only and may not follow a linear journey for every SIB and investor.

1. Understanding investor expectations

Once you are aware of an upcoming tender and you are satisfied that your program is suitable for a SIB, then it is worthwhile having some early conversations with potential investors to understand their expectations. Some questions to ask potential investors:

- What are your social impact objectives?

- What are your financial risk and return expectations for this type of investment?

- How much do you typically consider investing in SIBs?

- How would you like to be engaged throughout the SIB development process?

- What is your due diligence and approval process, and how long does it typically take?

These questions will give you an idea of how much capital you could secure for your SIB with a certain risk and return profile. However, at this early-stage, potential investors will not be able to provide you with a commitment to invest in your SIB.

2. Government request for proposals

As part of developing a detailed proposal for your program, you will also need to outline the proposed funding arrangements for the SIB. This includes:

- Contracting arrangements between parties, including the different entities involved and contracts between each party

- Investor terms, including the target financial return, term of investment and overall amount of capital required

Potential investors should be consulted if there are any requirements in the tender that affect investor social impact, risk and return expectations.

It can be helpful to seek in-principle commitments from potential ‘cornerstone’ investors to support your proposal, noting formal investor commitments come later in the development process.

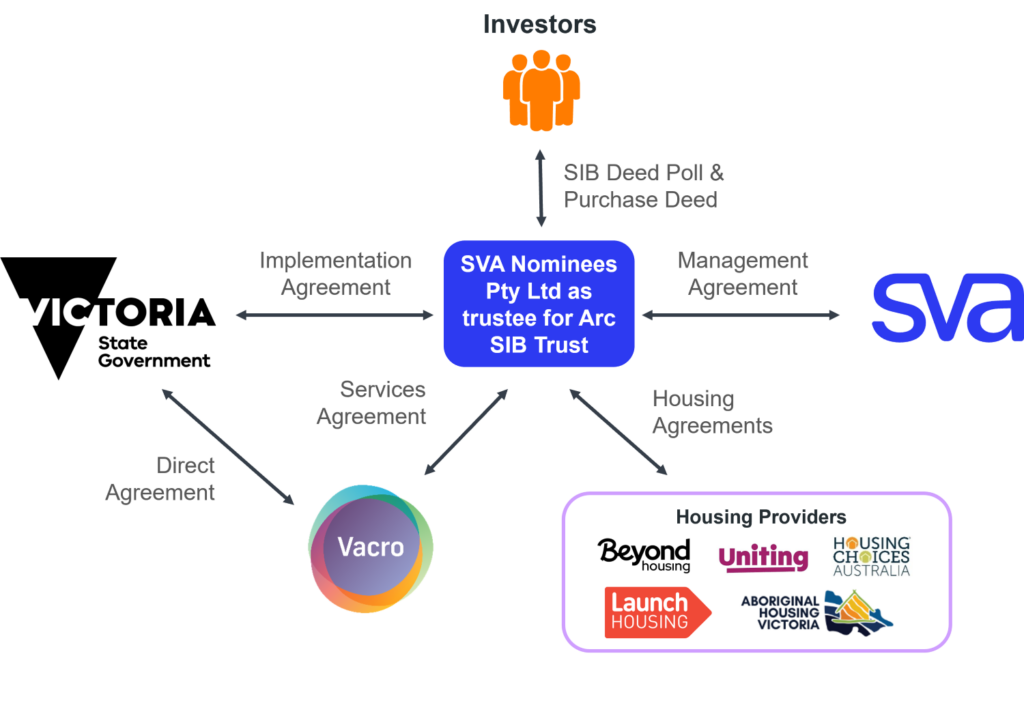

Arc Social Impact Bond

The Arc SIB funds the Arc program, which provides people leaving prison at risk of homelessness with at least three months of planning and rapport-building prior to release from prison, two years of innovative, intensive case management support post-release and access to stable housing. The Arc program is delivered by Vacro in partnership with a number of community housing providers. The contractual arrangements are summarised below:

Investor returns are linked to the Arc program’s effectiveness in reducing participants’ utilisation of justice, health and homelessness services. The return in the ‘target’ performance scenario is 8.3% per annum (with maximum return of ~12% if the program ‘outperforms’; ~40% loss of capital if the program ‘underperforms’ and terminates early). Investors will receive periodic updates on the program and payments, including annual reports, distribution statements and documents to support valuation of their investment.

3. Joint Development Phase

If your proposal to government for a SIB is successful, you will commence further development of your program and SIB with government (known as the Joint Development Phase or JDP). This phase will culminate in agreeing commercial terms with government and entering into an outcomes contract with government.

It is important to keep your investor base updated during this process on the following:

- Changes to commercial terms that may affect investors’ impact, risk and return expectations. Significant changes in the economic environment (for example, increases in interest rates) which affect risk and return expectations may also require re-engaging with your investor base. Any changes in investor expectations can be incorporated into your negotiation with government prior to finalisation of contracts.

- The likely timing of the capital raise. Your potential investor base will want to understand when they can expect to receive the detailed documentation to consider making an investment. Investors can take some months to do their due diligence, and need to factor in the timing of key decision-making meetings, so it’s helpful for them to start planning in advance.

Additional investors can be engaged during the JDP to gauge their interest in your SIB.

4. Preparing for the capital raise

Towards the end of the JDP you will also need to commence preparing for the capital raise, which includes formally marketing the SIB investment opportunity to potential investors.

To market the SIB investment opportunity to potential investors, an offer document (such as an information memorandum) needs to be developed, in addition to any supporting contracts.

5. Raising the capital

Once the outcomes contract with government has been executed, you can then proceed with the capital raise for the SIB. Most investors require a minimum of six months to participate in the capital raise, but this will depend on the investor and their due diligence and approval processes.

You can start marketing your SIB and distributing your information memorandum to potential investors. Potential investors will conduct an ‘initial screen’ of the investment opportunity, typically considering whether the investment opportunity:

- Aligns with their social impact objectives

- Meets their financial objectives, including risk and return parameters

Due diligence

Once a potential investor is satisfied that an investment opportunity aligns with its social impact and financial objectives, they will proceed to a detailed assessment of the investment opportunity (known as due diligence).

This typically includes the investor verifying (to the extent that it’s possible) key assumptions underpinning the proposed social impact and financial targets, and investigating key risks of the investment opportunity. Key risks typically examined by investors are outlined in the detailed guide.

Investors will review underlying contracts, financial models, and evidence supporting the SIB’s performance targets. They may also request additional information and conduct interviews with your organisation (and other stakeholders).

This step culminates in the investor agreeing to the investor terms through approval by the investor’s decision maker/s.

Legal documentation of the investment

Once the investment is approved by the investors, then the relevant contracts will be finalised and entered into. The form of these contracts will depend on the structure of the SIB.

Getting the funding

You will not be able to access the capital provided by investors immediately. There may be certain pre-conditions that must be satisfied before ‘financial close’ is reached and the funding can be accessed (often referred to as conditions precedent).

6. Implementation of the SIB and program

Upon completion of the capital raise (i.e. reaching financial close), you can now access the funding from the SIB and you are able to set the program up for service delivery.

Once services commence, the relationship with investors doesn’t end. There are ongoing reporting obligations to investors over the term of the program. Investors will want to understand how the program is tracking relative to plan and understand any key risks. See here for an Aspire SIB investor report. It is important to be transparent with investors and not misrepresent the program’s current or future performance.

There will also be ongoing payment obligations under the relevant terms of the investor contracts, and investors may also need to consent to contractual changes which might impact their returns.

Conclusion

Even with detailed guidance materials, developing your own SIB and engaging with investors can be difficult to do by yourself. Partnering with intermediaries like SVA or advisers can be helpful at different stages in the SIB development process.

Anglicare Victoria has also shared their reflections from their experience as a service provider raising capital for the Compass Social Impact Bond.

For examples of SIBs developed by SVA, including information memorandums which outline SIB investment opportunities to potential investors, see our website.

Author: Pat Bollen

Contributor: Kirsten Armstrong